By Glenn Ashton · 18 Mar 2013

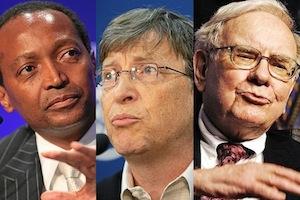

Warren Buffett has pledged to give away the bulk of his fortune to philanthropic causes. Bill and Melinda Gates are prominent benefactors. In South Africa, Patrice Motsepe has joined the club. Russia has Vladimir Potanin. These individuals are part of a wealthy class of philanthropists who assist causes close to their hearts.

Philanthropy is a strange beast, readily defined, more difficult to ring-fence and impossible to control. Founded upon altruism it becomes invariably entangled with ideology, politics and ego, all allied with differing degrees of alienation.

Consequently philanthropy has inherent flaws, which lie primarily in how it is controlled by the beliefs of donors, which are usually far removed from reality. How many steps have most philanthropists walked in the shoes of the poor? Can they even begin to relate to their plight?

Philanthropy by definition goes beyond mere altruism. Ideally it represents love for fellow people and the environment in which they live. Philanthropy is more than charity; charity is about providing food, philanthropy is more about enabling self sufficiency.

Modern philanthropy arose in response to public enmity to the excesses of the “robber barons” of the late 19th and early 20th centuries. Their unprecedented wealth created a new oligopoly, where political power was bought off, the media controlled and the vast majority consigned to poverty by a system that rewarded the few.

The past century has seen political currents ebb and flow, along with the waxing and waning fortunes of the corporate-political oligopoly. Yet the dawn of the 21st century witnessed a precipitate and unprecedented concentration of assets in the hands of the wealthiest one percent of the global population.

The instrument behind this capital acquisition by the “one percenter” oligarchy was market deregulation. This facilitated unrestricted financial transfers between nation states and tax havens, magnified through exotic investment instruments.

One result has been a sharp decrease in the proportion of global GDP collected as tax, lost through creative accounting and tax avoidance. This was recently highlighted by revelations of immoral tax avoidance by large multinationals like Amazon, Google and Starbucks Coffee in the UK, resulting in them paying pennies, if anything, from each Pound of profit. Simultaneously national and household debt has surged.

The proportion of global wealth sequestered from taxation has prevented reinvestment and recirculation into local and regional economies. The robber barons and randlords of a century ago were timid operators compared to these marauding free-market marquises. Legislation curbed the robber barons; now we are effectively ruled by the most rapacious first estate in history, which possesses such huge resources it feels untouchable.

The elite have created forums like the World Economic Forum, fawned over by their media analysts. International institutions like the United Nations have been captured through corporate charters. So too with academic institutions and political parties worldwide. The poor remain marginalised, the middle classes plundered, all with nary a bleat from academic, global or economic leadership, let alone what passes as the free media.

This creates the ideal climate for the oligopoly. The middle class is blamed for the situation by the poor while the rich remain insulated in their isolated ivory towers, their tax havens and their exclusive resorts. In order to gain support and provide legitimacy, they partake in largesse portrayed as philanthropy. This conditional money has never been intended or able to transform the global status quo; instead it is a sop, creating talking points.

Thus is the contrived edifice of modern philanthropy is exposed as the sham it is.

In the mid-twentieth century, wealth distribution was far more egalitarian. Governments were the primary instruments in wealth redistribution. After the great depression state support of the poor was a sine qua non of national rule. This continued after the Second World War, becoming internationally supported through the UN. The state supported healthcare, infrastructure and assisted the unemployed in various ways. Food and health assistance was generously extended to developing nations.

These safety nets were incrementally dismantled under Reagan and Thatcher’s neo-liberal policies, influenced by Milton Friedman’s economic theories. Subsequent global deregulation led to World Bank and IMF structural adjustment policies, inevitably creating greater inequality.

This neo-liberalism was gradually eclipsed by far more aggressive free-market libertarianism, informed by Ayn Rand, the Chicago school of neo-conservatives and the Austrian school of economic thought. This was epitomised by US Republican Party policies under President Bush and Dick Cheney, and is echoed by the Conservative parties of Canada and the UK, Italy’s PDL and France’s National Front. Even the UK’s New Labour under Blair fell under the spell of this collective economic insanity.

Instead of money being redistributed by national governments, as ostensibly neutral arbiters, control has been seized by new moneyed individuals, each striving to outdo each other in putting the world to rights. Modern philanthropy is little more than the illegitimate privatisation of state planning, aid and redistributive policies. Philanthrocapitalism is a misleading smokescreen for business as usual.

For instance, the Gates foundation has been criticised for both investing in GMO food giant Monsanto (and Coca Cola and McDonalds), while simultaneously actively promoting GMO crops as a technological solution to hunger amongst developing nations. Gates is convinced that techno-fixes which align with his world view must be pushed, hard. He appears unable to grasp that agricultural failure in Africa is primarily the result of poor infrastructure, market distorting OECD agricultural subsidies and inadequate state investment in farmers and training.

Likewise the supposed philanthropy of the Koch (pron. coke) brothers, who are together worth more than the world’s richest man, the Mexican Carlos Slim. Koch money is directed toward conservative think tanks like the American Enterprise Institute and the Knowledge and Progress Fund. These, along with other players, have effectively undermined United Nations led attempts to curb climate change, while simultaneously promoting right wing causes. Not coincidentally, the Koch brothers are heavily invested in fossil fuels.

Most philanthropic donations are tax exempt. This enables the wealthy to write off profits, further diminishing their real tax burden by reducing income tax, lessening available finances for government programmes, perpetuating the cycle. These ideological philanthropists insist on their right to choose where their money is spent. However this is only part of the story.

The bulk of philanthropic donations in the US, the world’s richest country, do not support the poor. Instead causes allied to wealth are supported – arts, medical and educational facilities. Around two thirds of the money directed toward colleges went to the affluent colleges serving the rich, while middle class colleges remain underfunded and underserved.

We know there is an inherent and profound disconnect in how the wealthy perceive the needs of ordinary people, let alone the poor. A convincing argument can be made that they should not be the final arbiters of disposal of their excess wealth. After all, do we live in a democracy or an oligarchy? The voices of the poor are profoundly under-represented in the decision-making processes of philanthropic organisations.

While philanthropic donations increase in quantity, these are tied up with strings ensuring recipients dance like puppets to their tune. Egalitarian reform becomes increasingly difficult as this privatised aid, supervised by philanthropic grant makers, support the wishes of the elite above the interests of the needy.

Our only hope in reversing this coup of international governance lies in demanding radical reforms. As a start, local, regional and national financial regimes must be reformed in order that taxes are not avoided but paid to be redistributed by the governments voted for by the people, not by self-interested individuals.

Tax havens must be curbed. The world leader in tax haven creation and support is the UK – Bermuda, the British Virgin Islands, the Cayman Islands, the Isles of Man and Wright are little more than offshore branches of London’s Square Mile for the super rich. We need to gain control of money that is ours, for ourselves.

When we credulously believe that philanthropists are the epitome of generosity and goodness, we enable their essentially self-serving actions, along with a system which elevates the pursuit of profit above social and environmental good. In its most recent guise philanthropy has simply become an integral part of a system that is killing the world.

Posts by unregistered readers are moderated. Posts by registered readers are published immediately. Why wait? Register now or log in!

Banks

Glenn I could not agree with you more. The problem starts however well before the weakening of national tax regimes. The fact that banks are legally allowed to issue new money into circulation without any backing in new goods and services means that they are legally authorised counterfeiters. You or I wuld be sent to goal if we were fund guilty of counterfeiting and rightly so because counterfeiting is theft.

Counterfeit currency because it does not have the requisite backing in new goods and/or services has to steal its value from the currency already in existence and the consequence of this theft of value is the debasement of the currency, commonly known as inflation.

It works like this. The first users of counterfeit money can purchase goods or services at the value the counterfeit money purports to represent. They can do this because it is not possible to recognise that the money is counterfeit. However as the counterfeit money passes from hand to hand the players in the economy begin to pick up that the ostensible value of the amount of money circulating in the economy exceeds the value of the real goods and services actually available in the economy and as a consequence the monetary prices of goods and services increase in order to reflect this.

This means that existing currency is constantly falling in real value which means that the purchasing power of people's earnings, or savings, is being constantly eroded by the falling real value of the currency.

On the ther hand first time users of counterfeit currency are at an advantage compared to every one else, they can purchase goods and services at the ostensible value of the counterfeit currency because the debasement of the currency has not yet filtered into the wider economy.

The first time users of this counterfeit new money are people who take out loans from banks and banks will not grant loans to those who do not already have wealth of some kind. The ongoing economic impact of this stuation has been a steady shift of monetary wealth up the economic pyramid with the consequent increasing impoverishment of those lower down in the economic pyramid.

The right of banks to issue counterfeit new currency without any backing in new real goods and services must be revoked as a matter of urgency.